Past The Real Estate Market Bottom With Brighter Days Ahead

In this episode, I interview Ben Miller, the CEO of Fundrise, discussing his revised perspective on the real estate market for 2024 and beyond.

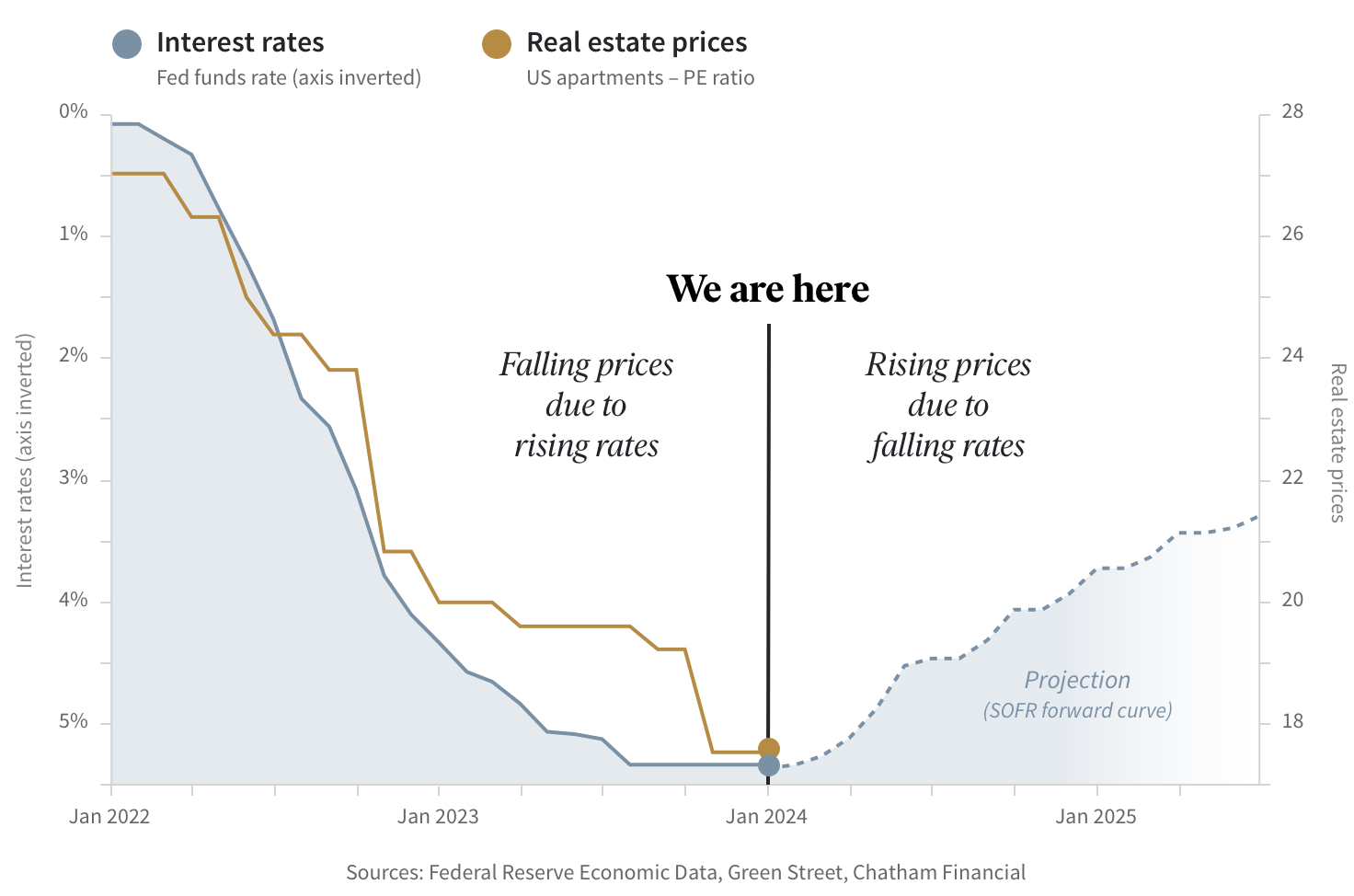

The year 2023 posed challenges for institutional real estate investors, marked by 11 rate hikes and a significant surge in mortgage rates since the first quarter of 2022. As a result, institutional real estate prices declined.

Ben believes October 2023 represented the low point for the real estate market after experiencing 18 months of continuous decline. His current optimism stems from an expected decrease in interest rates.

The following chart provides a concise summary of his viewpoint and outlook.

In this real estate market episode, we explore several key topics:

- The reasoning behind Ben’s belief that October 2023 marked the bottom, and the less obvious indicators supporting this perspective.

- Understanding the motivation behind why some are selling near the bottom

- The possibility of using one fund’s cash to support a deal in which another fund is investing.

- Ben’s insights on investing in office properties at significant discounts.

- Drawing parallels between e-commerce and the work-from-home trend, highlighting the potential permanent increase in the value of residential properties.

- Emphasizing the importance of investing in alignment with macroeconomic tailwinds, not headwinds.

- Discussing the potential percentage upside in institutional real estate prices for 2024 and 2025.

- Exploring the methodology for calculating the Net Asset Value (NAV) of specific properties within the fund.

- Recognizing the non-linear nature of significant changes and the importance of staying invested to benefit from high catalyst moments.

- Reflecting on Ray Dalio’s perspective – “I’d rather be approximately right than precisely wrong” – especially in the context of predicting year-end interest rates.

- Considering the viewpoint that a recession might be bullish for real estate due to the potential rapid and extensive decline in interest rates.

You can listen to the episode on Apple, Spotify, or Google. Or you can click the embedded player below. If you listen to my previous episode with him, he was decidedly more bearish.

If you want to dollar-cost-average into a Fundrise fund, you can do so by clicking here. The investment minimum is $10. Financial Samurai is an investor in Fundrise and Fundrise is a long-time sponsor of Financial Samurai.