Are No-Penalty Add-On CDs the Future?

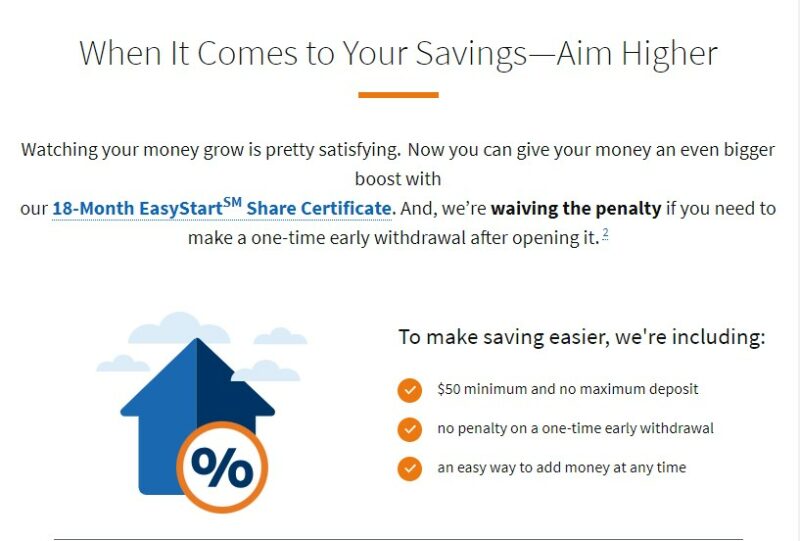

Reader Mike sent me an intriguing certificate of deposit offer from Navy Federal Credit Union – their Limited-Time Offer: 18-Month EasyStart Share Certificate. It’s a no-penalty add-on CD with an 18-month term, coupling two features I’ve never seen together (yet).

I have no relationship with Navy Federal Credit Union, so I can’t speak to the experience of using their CDs, but Mike did and said that he previously had an add-on CD that worked well:

But, I have one from a similar offer they made last year. It was a 15-month add-on CD (not a no penalty CD), APY was 5.0% and I have made a small deposit every month since I opened it.

Here’s why I find it interesting:

- It’s a no-penalty CD – 7 days after opening, you can make one full or partial withdrawal from the CD without paying a penalty.

- It’s an add-on CD – you can add money to the CD at any time during the term.

The current yield on the CD is 4.70% APY, which is less than the highest no penalty CD rates and high yield savings account rates. The rate is a bit lower for that flexibility but it’s still better than what you’d get for a traditional CD at your local brick and mortar bank.

Banking products are becoming more flexible

It seems there’s a trend towards banking products becoming more flexible.

Before smartphones and online banks, you had a checking account, savings account, and certificate of deposits. You could only transact six times on a savings account or face penalties. Your checking account was meant for transactions and paid you no interest. Everything else was “savings,” and even then, the interest was terrible. CDs were strict – you could only deposit money once and were penalized heavily for withdrawing your money before the CD matured.

Nowadays, it seems like it’s all getting mixed together, especially if you are working with an online bank. Checking accounts pay interest, though savings and CDs pay more. And they’ve even suspended the 6 ACH rule, so you can have as many transfers as you want between savings and checking.

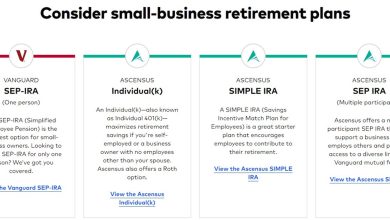

Finally, you have all kinds of CDs – no-penalty, add-on, no-penalty add-on, bump-up, etc. And with online banking, it’s become even easier to open up a CD. You don’t have to visit a branch and talk to a teller or banker, you can do it completely online or through the app.

This latest offer from Navy Federal Credit Union exemplifies this trend towards flexibility. Now you can get a CD that you can withdraw from without penalty and add to it whenever you want.

Is this the future?

Personally, it’s probably a response to how easy it is to open a CD.

The CD has a minimum of $50 so if you really wanted flexibility, you can open multiple small CDs and then Navy Federal has to deal with all the paperwork (probably computerized anyway but still). The add-on feature is less amazing when you realize you can just keep opening more CDs. In this case, you know what the rate is and in a falling rate environment, that can be a benefit.

I think that these types of CDs are similar to bump-up CDs, where in a rising rate environment you can bump up the interest rate of a CD to the prevailing rate. They exist in part because customers have such low friction in changing products.

In the past, you had to visit a branch and transact in person. It’s way faster now.

Am I really going to waste an hour going to the bank to get 0.10% APY higher? No way.

Will I spend 5 minutes on my phone while I’m waiting around? Sure.

I’m eager to see if this trend becomes the norm.

Other Posts You May Enjoy:

State-by-State Home Energy Rebates from Inflation Reduction Act

The Inflation Reduction Act included two provisions that offered tax rebates and credits for energy efficient home improvements. We take a look at those provisions and how states will implement them.

Don’t personally identify with your investments

Tribes are great when it comes to sports. It’s fun to cheer for something and wear its gear. It becomes dangerous when this tribalism extends into the realm of investing.

9 Apps Like MoneyLion

MoneyLion is a personal finance app offering cash advances, credit cards, and personal loans. You can also invest in fully managed portfolios as well as crypto. But MoneyLion isn’t the only fintech offering these types of services. Here are 9 apps like MoneyLion. Learn more.

Tello Review: Customizable Phone Plans for the Entire Family

Tello is a discount wireless provider offering customizable cell phone plans for the family. There are no contracts or additional fees, and you can add family members or change your plan at any time. How does Tello compare to other discount wireless providers, such as Mint Mobile and Twigby? Find out in this Tello review.

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools,, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.