Staging A Home Is Worth It Because Most Buyers Lack Imagination

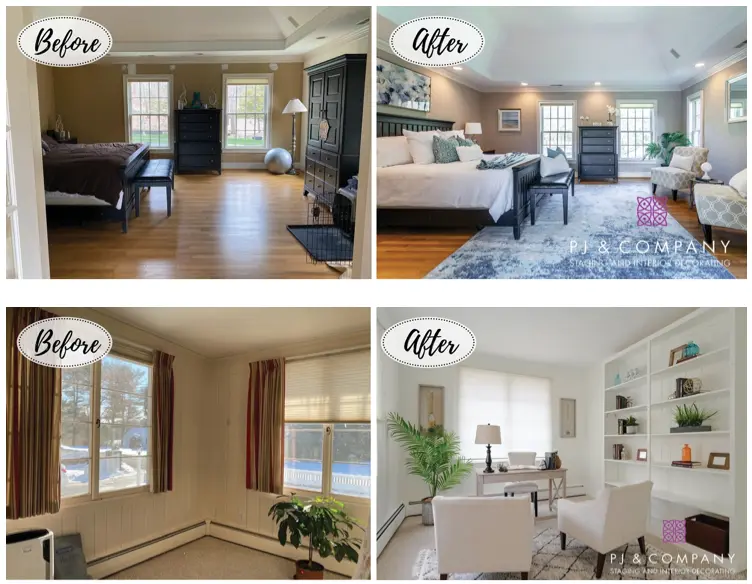

When it comes to selling a home, first impressions are everything. Yet, many sellers make the mistake of thinking buyers can look past an empty room, outdated furniture, or a poorly lit space. The reality? Most buyers have little imagination. They struggle to visualize a home’s true potential unless it’s presented to them in a polished, aspirational way.

This is why staging a home is one of the highest-ROI strategies you can use when selling. A well-staged home creates an emotional connection, helps justify a higher price, and speeds up the sale. In a competitive market, it’s often the difference between multiple offers and your listing sitting for months.

As someone who has bought and sold multiple properties, I’ve tested both approaches—selling staged and unstaged. The results? Staged homes always attracted more interest, leading to stronger offers.

I was skeptical about paying for staging for years. But in hindsight, the three best deals I ever purchased were on unstaged homes. There was far less competition, and the sellers were more receptive to my real estate love letters and quick-close offers. Sellers of unstaged homes often gave the impression they just wanted a quick sale with minimal effort and expense.

If you’re on the fence about staging, here’s why it’s worth it. I’ll also share the estimated cost to stage various types of property, as well as how to get staging done for free.

Most Buyers Can’t See Beyond What’s in Front of Them

It’s easy to assume buyers can picture how a home could look with their furniture and style. But most people struggle with spatial awareness. If they walk into an empty living room, they often can’t tell whether a sectional will fit. If a bedroom is poorly arranged, they might assume it’s too small for a queen-size bed, even if dimensions say otherwise. All these doubts put the brakes on submitting a strong offer.

This problem is even worse with outdated or unattractive interiors. A 2021 report from the National Association of Realtors (NAR) found that 82% of buyers’ agents said home staging made it easier for clients to visualize a property as their future home. Unstaged homes, especially those with strong personal decor or wear and tear, create doubt.

Buyers aren’t just shopping for a house; they’re shopping for a feeling. They want to step inside and instantly picture themselves living there. Take out those personalized items and pictures! If they have to work too hard to imagine that feeling, they’ll move on to a home that makes it easier for them.

Staging Helps Justify a Higher Price

The goal of staging isn’t just to make a home look nice, ultimately, it’s to increase perceived value. The better a home looks, the more buyers believe it’s worth.

A 2023 survey from the Real Estate Staging Association (RESA) found that staged homes sold for an average of 5-10% more than unstaged homes. This makes sense because buyers emotionally attach value to a space that feels move-in ready.

Let’s say you’re selling a home for $1 million. A 5% higher sale price from staging translates to $50,000 more in your pocket. Compare that to the $5,000–$8,000 you might spend on professional staging—it’s a strong return on investment.

The psychology behind this is simple. When buyers walk into a beautifully staged home, they assume:

- The home has been well cared for

- It’s in better condition than unstaged homes

- They can move in with minimal effort

In contrast, an empty or poorly presented home invites doubts:

- “Will my furniture fit here?”

- “Does this awkward room layout work?”

- “How much will I need to spend on remodeling?”

- “Why is the seller so cheap? Is there anything else they are cheapening out on?”

The more questions buyers have, the less willing they are to pay top dollar, if anything.

The Cost of Staging a Home

While staging clearly adds value, many sellers hesitate due to the cost—I was one of them for years. What finally convinced me to give it a try was realizing that selling a home is already expensive, so spending a little more to present it in the best possible light felt worth it. At least I was getting something from it versus just paying transfer taxes and fees.

The good news? Staging doesn’t have to break the bank.

Low-End Staging Costs ($500 – $2,000):

- DIY staging with decluttering, rearranging existing furniture, and adding fresh decor

- Professional consultation with a stager ($200–$600) for personalized recommendations

- Renting a few key furniture pieces for staging select rooms

Mid-Range Staging Costs ($2,000 – $10,000):

- Partial professional staging for key areas (living room, kitchen, master bedroom)

- Short-term rental of furniture, art, and accessories

- Professional photography and lighting enhancements

High-End Staging Costs ($10,000 – $20,000+):

- Full home staging, including all rooms and outdoor spaces

- High-end furniture and decor rentals for luxury listings

- Longer rental periods for staged furniture if the home sits on the market

Staging costs also vary by home size. A small condo may only require $1,500 to stage, while a 4,000-square-foot luxury home might need $20,000 or more to stage properly.

Virtual Staging ($30 – $100 per image) is a cheap alternative for vacant homes. It involves digitally placing furniture in listing photos, which is more affordable than physical staging. However, while it makes photos look appealing, buyers may be disappointed when they walk into an empty space.

When it comes time to do your taxes, know that the cost of staging is an expense that lowers your capital gains, if any.

A Smart Strategy To Save 100% On Staging Costs

After the NAR’s commission price-fixing settlement, home sellers are more empowered than ever to negotiate the cost of selling. One savvy way to save on staging is to ask your agent if they’re willing to cover it as part of their commission. If they really want your listing, they just might say yes.

In most cases, you’ll still need to pay the staging fee upfront as a safeguard in case the home doesn’t sell. But if it does, your agent can credit the full cost back to you at closing.

Seasoned agents often have strong relationships with stagers and can secure better rates—so it may cost them less than it would cost you anyway. In the end, everyone wins.

Staged Homes Sell Faster

Given that staging often leads to a higher sale price and faster sale, the investment typically pays for itself. But you and your agent must list the home properly in order to get as many potential buyers in as possible.

Homes that sit on the market too long often require price cuts, making staging an essential strategy for maximizing profit. Stale listings is a seller’s worst nightmare. I sold our old home in 2017 unstaged and we only got one offer. Escrow also took 48 stressful days until it closed. Meanwhile, another property I sold with staging sold in two weeks.

According to NAR, staged homes sell 73% faster than unstaged ones. Why? Because staging creates a sense of urgency. When buyers see a home that’s move-in ready, they’re more likely to make an offer quickly. Just imagine how much more attractive a stage home is if you have a baby on the way.

A staged home also photographs better, which is crucial in today’s digital-first real estate market. More than 90% of buyers start their home search online, and if your listing photos don’t stand out, you’ll lose potential interest before a buyer ever steps foot inside.

Staging Matters Even in a Strong Housing Market

Some sellers think, “The market is hot—I don’t need to stage.” But that’s short-sighted. In any market, buyers are still looking for the best value.

A well-staged home doesn’t just attract more offers; it creates better offers. In competitive situations, buyers are more likely to waive contingencies, increase their bid, or offer cash if they feel emotionally invested.

Even in bidding wars, staging helps maximize final sale price. Buyers making quick decisions based on emotion will stretch their budgets if a home feels “perfect” to them. A staged home minimizes hesitation and increases perceived scarcity.

How to Stage Your Home for Maximum Impact

If you’re convinced staging is worth it, the next step is figuring out the best approach. You don’t always need a professional stager, but there are some key principles to follow:

- Declutter and Depersonalize – Remove excess furniture, family photos, and personal items. You want buyers to see themselves in the space, not your life story.

- Create Defined Spaces – Every room should have a clear purpose. If you have an extra room, stage it as an office or guest bedroom rather than leaving it empty.

- Neutralize the Decor – Bold colors and unique design choices might appeal to you but could turn off buyers. Stick with neutral tones that appeal to the broadest audience.

- Maximize Natural Light – Open all curtains, clean windows, and add light fixtures where needed. You might consider removing curtains altogether. A bright home feels bigger and more inviting.

- Boost Curb Appeal – The first impression starts outside. Fresh mulch, trimmed landscaping, de-weeding, and a clean entryway make a huge difference. Spend time power washing the walls, entryway, and driveway.

- Stage Key Rooms First – If you’re on a budget, focus on the living room, kitchen, and primary bedroom—these are the rooms that influence buyers the most.

- Invest in Small Upgrades – Fresh paint, new cabinet hardware, and modern light fixtures are inexpensive ways to elevate the look of a home.

To get a better sense of interior design, I highly recommend you see at least a dozen staged homes in person before staging your own. With experience, you will naturally get a better idea of what looks good, and what looks cheap and out of place.

You Can Push Back Against The Stager Too

If you’re hiring a professional stager, they should have the expertise to make your home look its best. However, don’t hesitate to push back if a furniture arrangement or fixture change doesn’t feel right to you.

For example, our stagers initially placed large stools under our center island, but once we tested it out during lunch, we realized there wasn’t enough space between the stools and the dining table. While they believed the setup was fine, I asked them to adjust it to allow for better flow.

They also suggested removing the two light fixtures over our kitchen sink and capping them for $200 instead of replacing them with matching recessed lights. Their reasoning was that it would open up the space and highlight the views. But since the lights had never bothered us when we bought the home and actually enhanced the kitchen’s functionality, we decided to keep them and save.

While staging can make a home more appealing, it’s important to balance design choices with real-world usability—especially if you’re still living in the home while selling.

Final Thoughts on Staging a Home

As someone who values cost-efficiency, I get why staging can feel like an unnecessary expense. Spending thousands just to help buyers picture a home’s potential—only to return the furniture a month later—can seem wasteful.

But the truth is, staging takes real effort, from movers to designers, and their expertise often helps you sell for more. Most buyers simply don’t have the imagination, especially in expensive cities where few have bought multiple homes.

After our home was staged, my wife and I were completely blown away. And this is coming from someone who has seen hundreds of staged homes and purchased multiple unstaged fixers. My estimate of what our home could sell for jumped by at least $50,000, compared to the $10,000 staging cost, which was covered by my agent. In fact, the transformation was so dramatic that I reconsidered selling altogether! That’s how powerful staging can be.

Selling a home is as much about marketing as it is about property value. Buyers aren’t just looking for square footage, panoramic views, a large lot, or a prime location. Buyers need to feel an emotional connection the moment they step inside, which is what staging helps create.

Given the strong return on investment, skipping staging is probably a costly mistake. If you’re preparing to sell, take the extra step to present your home in the best possible light. Most buyers lack imagination—but with the right staging, they won’t need it.

Would you stage your home before selling? Have you ever bought a home that was staged? I’d love to hear your experiences.

Suggestions

If you want to invest in real estate without the headache of remodeling, check out Fundrise—my preferred private real estate platform. Fundrise focuses on high-quality residential and industrial commercial properties in the Sunbelt, where valuations are lower and yields are higher. With an investment minimum of only $10, I’ve diversified my portfolio by investing over $300,000 in Fundrise. Fundrise is a long-time sponsor of Financial Samurai.

Pick up a copy of Millionaire Milestones: Simple Steps To Seven Figures if you want to build more wealth than 93% of the population and be free sooner. Amazon just started a 10% sale ahead of the book’s May 6, 2025 launch!

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise. Staging Your Home is a FS original post.

Source: Staging A Home Is Worth It Because Most Buyers Lack Imagination